For example, there was retail buying of Rs 21,000 crore on election day, it cannot be the maximum participation on that day. SIP flows, options activity, volume activity. What about maximum participation? Is it a benchmark?

Where? If you look at household balance sheets, they still have more gold than equities.

No, I’m just trying to get the point across.

They have more fixed income than equities. In the US, equities are 40% of the household balance sheet. In Europe, it’s 50%. In India, real estate is 50, gold is 12. Equities are in single digits. There is no peak participation. In fact, I don’t see widespread ownership yet.

Unlock leadership excellence with a range of CXO courses

| College Offers | Duration | Website |

|---|---|---|

| Indian School of Business | ISB Chief Digital Officer | visit |

| Indian School of Business | ISB Chief Technology Officer | visit |

| IIM Lucknow | Chief Executive Officer Program | visit |

I think it’s going to come now and look at it not based on the number of people but based on the exposure they have.

What percentage of their balance sheet is in stocks? Well, we have achieved that breadth in the last seven-eight years, thanks to a lot of work done by the government, the regulator, the mutual fund industry, hats off to all of them.

They have achieved breadth but not depth. People are not taking more money and they are just coming and learning about this market. They are opening their accounts and so we have probably 10 crore portfolios or I think 8 or 9 crore PAN numbers who are actively trading stocks in some form or the other, this number may go up to 18 but those 9 crore people still do not have enough exposure. So, both depth and breadth will increase. I don’t think we are at the peak.

That’s great. So, in terms of market behavior, which we always keep an eye on, you have a lot of proprietary indicators. I know you work on those. They are not indicating that there is any mass euphoria or mania in the market.

Not at all. My proprietary sentiment indicator, thanks for bringing it up, is in the neutral zone.

Oh wow.

The market is at an all-time high. It is in neutral territory. The market is at an all-time high. So, it is nowhere close to suggesting that we are headed for a major sell-off.

But you’re also saying this bright blue sky will last for another four years?

Yes, it has ups and downs. It is never going to be a straight line. Everyone should be aware of this.

When markets start behaving like fixed deposits, you get a bit worried. Every morning when you arrive, it is up 0.5%, stock markets should not be like this. So, one day we will arrive and the market will be down 2%.

That Tuesday, you know what I’m talking about. So, let’s start putting the numbers into a framework. Framework is a word that Ridham Desai uses. We don’t use it. So, I’m going to borrow it from her. India’s GDP is going to grow somewhere between about 6.5% to 8.5%, depending on the cuts and the estimates you look at. There’s going to be 4% to 5% inflation, which means nominal GDP is going to be in double digits.

Yes, around 10% to 11%. I think you made the numbers a little more optimistic than I was. I think 6.5-7 for GDP, a narrow range, and probably around 4% for inflation.

So, 10% nominal increase is coming.

10 to 11, yes.

In this, which sectors do you think will beat the nominal GDP growth handsomely because the 10% tailwind is coming for everyone. The trick is to identify where you will get that extra 4% or 5%. So, where do you think it is coming from?

So, I think credit growth will be 15%, so that’s pretty easy. I think capital expenditure will be 15%. So, both of these are pretty easy. As a result, I think consumption will improve somewhat, but consumption will probably lag behind both of these sectors as it did between 2003 and 2007.

People have forgotten that. You look at consumer staples stocks, they were performing very poorly in that cycle and when we got to February 2008, they were trading at an all-time low on relative valuations.

There was a pop last Tuesday as everyone thought the election results sent a message about populism. I strongly disagree, but consumer staples stocks will continue to underperform as they are unlikely to produce nominal GDP growth.

We have our own proprietary indicators. We worked on this 15 years ago. So, we have newsroom indicators and analyst indicators. Analyst indicators are when we meet analysts, we try to see where there is excitement and where there is no excitement. So, in 2008, I met an FMCG analyst. He said I am an FMCG analyst, who asks me? It is the same with IT now.

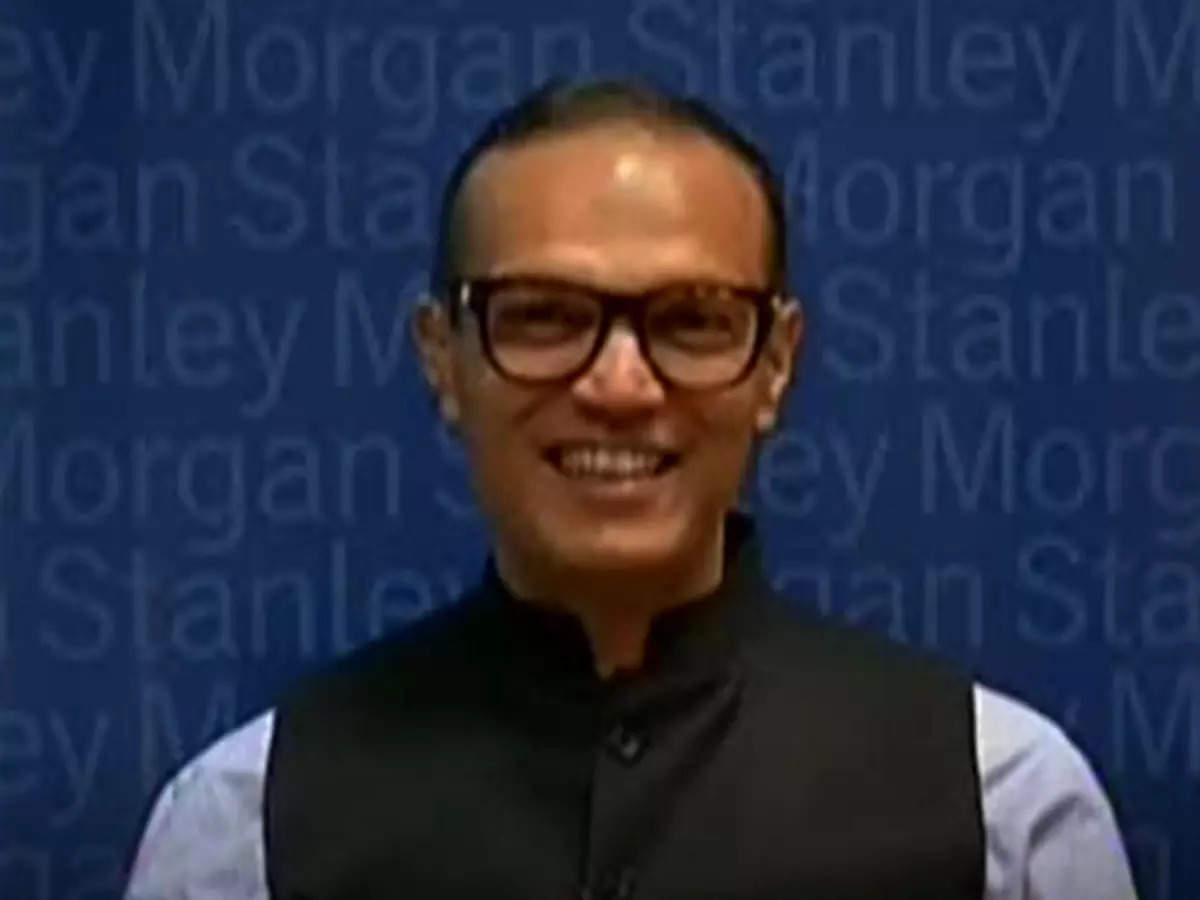

Sorry, I’m interrupting you. In February 2008, I had a report that had an incredible title. It was called The Return of Hozefa Topiwala. Hozefa was my consumer, he was my consumer staples analyst and he was very sad.

He came to me at the end of January and said Ridham get me another job. My career was going nowhere and I felt this was the right time. So, in February 2008, I got very lucky with the timing. After that consumer staples stocks went up steadily for 10 years.

Is your IT analyst saying the same thing?

No, no. Nobody is saying that right now. This is in a way very different from that cycle. Every cycle has its own nuances. But of course, my industrial analyst and my bank and my non-bank analyst are in a very good position. The IT guy is not unhappy at all because there are a lot of internet listings in the pipeline. So, he covers the internet as well. So, he has something else to do.

Where are some of these internet companies going? Five years from now, they can go from big to big, from big to mega. They have learnt the hard way that profit is important, cash flow is important, the terminology has changed. When you look at Zomato or for that matter, even Nykaa or even Paytm, talk about profit, where are these businesses going next?

Look, let’s broaden this. You asked about the internet. I think the internet is too narrow. Let’s talk about deep tech. I’ve been talking a lot about deep tech. The internet is outdated now. It’s yesterday’s story. That was 20 years ago. It’s deep tech now. India is incredible on its innovation trajectory. And I know a lot of people are critical about the lack of innovation in India. But tell me one country in the history of the world that wasn’t in the top 100 in terms of per capita income and was still innovating. Nobody.

When you are so poor, you don’t innovate. You focus on taking people out of poverty. But India is innovating. Whether it is artificial intelligence, whether it is space, whether it is defence, whether it is machine learning or new drug innovation, there are 3,000 plus startups doing an incredible amount of work, which I think is a risk to the Indian growth story. These are the companies that will come to the market. And these will be very exciting stories for many people. We have not seen such companies in India. We have seen very traditional business as usual, because we are still a very small economy in terms of our per capita income.

As this number grows, these businesses will flourish there. So, I believe India is at the forefront of technology in terms of some of these things.

And I think that’s going to happen in the next five to seven years. The Internet, for sure. The Internet is becoming more subtle. It’s just a business now.

It is no longer the kind of terminal growth it was 20 years ago. Its terminal growth is a little bit higher than other businesses, but it is not much different than these deep tech enterprises that are doing very different things.

(You can now subscribe to our ETMarkets WhatsApp channel)